Identify customer churn and potential at an early stage

Customer retention is an important issue for health insurers, especially because attracting new customers is many times more expensive than investing in maintaining the existing customer base. But how can we identify customer churn and potential at an early stage? Churn management deals with the prevention of customer churn and, if implemented correctly, is an excellent example of creating added value using data science and machine learning. Since the implementation of churn management can be a complex undertaking, it makes sense to use a well thought-out process model. Existing initiatives are integrated and technical and organizational challenges are identified and addressed at an early stage.

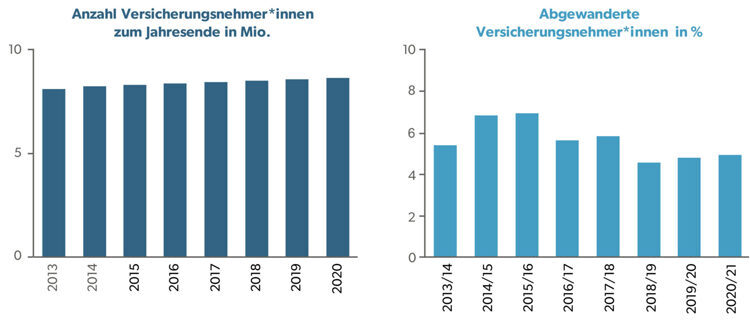

Customer churn plays a relevant role for health insurers. This can also be calculated from the statistics of the compulsory health insurance (OKP)1. If we look at the changes in the number of policyholders over each turn of the year, we see not only that the number of policyholders is steadily increasing, but also that about 5% of policyholders change the OKP each year. Although this rate is rather moderate compared to other countries and insurance systems (Netherlands about 6.5%), it corresponds to more than 400,000 policyholders leaving their current OKP for a new one every year. If one also considers that customers potentially also change the provider of their supplementary insurance when they change their OKP, the relevance of customer churn can quickly be seen. Last but not least, customer churn also reduces the potential for up- and cross-selling. This background shows the relevance of churn management and illustrates that health insurers should keep an eye on the entire customer lifecycle.

The challenge of customer churn is not a problem specific to health insurers, but affects many industries, including telecommunications and property insurance. Interestingly, studies from a wide range of sectors show that acquiring new customers is many times more expensive than investments aimed at retaining customers. How dramatic this effect is varies between industries. In any case, however, it can be observed that it is cheaper to retain customers than to acquire new ones. In particular, acquisition costs for marketing and discounts, but also expenses for onboarding administration have a contribution to make. This also applies to the Swiss insurance market, although regulatory issues such as risk equalization between health insurers must also be considered here. In addition, it is apparent that the acquisition of new customers in the insurance sector is particularly challenging. Particularly in the case of OKP, where the benefits catalog is formally defined, differentiation between health insurers is apparent to many customers primarily through the premium level and, to a lesser extent, through the experienced customer service.

The change of OKP typically takes place at the turn of the year. Another look at the OKP statistics shows that the majority of insurers have lost customers over one of the last five year changes. Health insurers that limit churn can see net increases in insureds, creating an advantage in the highly regulated and competitive health insurance market.

In order to realize this advantage as quickly as possible, Eraneos has developed a solution that not only addresses the multi-layered challenges (e.g. development of churn prediction, data availability, identification of measures), but also takes into account that isolated topic-related initiatives have already been launched in many organizations. Iteratively and based on the available data, the solution approach leads to an efficient management of customers willing to switch.

Churn management deals with customers who are willing to change and offers opportunities to identify them at an early stage and to influence their whereabouts in a positive and targeted manner. Churn is an English word made up of the words "change" and "turn".

Churn management is widespread in many industries. In particular, churn management is used intensively for companies with many customers who are bound to limited contract periods (e.g., telecommunications, software-as-a-service services). Churn management has also been increasingly applied in the insurance environment in recent years.

When introducing effective churn management, a broad collaboration of experts from various fields is essential. Experts in the health insurance market and data analytics experts, together with methodologists and marketing professionals, form the heart of churn management projects. Other roles, such as data protection officers and IT experts, round out the overall project. Eraneos can not only provide experienced professionals on the way to implementing churn management, the Eraneos solution also ensures that the required profiles and next steps are identified early on.

1. quantify

While the previous considerations may be plausible, the question for health insurers is to what extent churn management should be pursued. This should be answered as early as possible. To this end, this step quantifies the financial loss caused by customers who have churned and those who are willing to churn. Since this involves evaluating customer databases and identifying and correcting overlapping trends, close cooperation between data analysts and experts is essential at this point. Customer and sales data are the main data sources.

This initial analysis not only creates an understanding of the influence of churn on the core business, but also documents the initial situation so that it is possible to compare the improvement measures with the initial situation. Coupled with an inventory of churn management activities already underway, a lean business case for the introduction of churn management can be created.

2 Understanding and predicting

While the previous step focused on the overall impact of churn, the next step is to look at churn behavior on an individual level. The goal here is to understand customers well enough to 1.) know the key triggers of churn and 2.) predict for existing customers in the future who will be willing to switch insurance.

There may be some fairly intuitive indicators of insureds with churn intentions. Examples include a change in living situation, recently denied reimbursement requests, or customer service issues. However, the reality is often much more complex and intriguing. Machine learning approaches are predestined for predicting churn intentions, as they can be used to infer complex relationships from the available data. However, the interpretation of the churn factors found should also receive enough attention, which is why the close cooperation of subject matter experts and data analysts should not be underestimated in this step. Data protection officers should also be involved at an early stage. By working in cross-disciplinary teams, it is also possible to recognize more quickly whether the findings of churn management (e.g., the identified reasons for churn) can also provide added value in other areas of the company.

Churn management is already a highly relevant topic in numerous industries. For this reason, several commercial products exist for the development and provision of prediction models, which are usually based on machine learning. Whether individual products are the ideal choice or whether a customized model is preferable depends on the use case, the existing application landscape, and the available resources.3 The decision for or against a commercial product is complex and has profound consequences, which is why it should be made carefully and with adequate expertise.

In order to best understand customer behavior, high-quality data is an advantage. Possible data sources here can also be customer and sales data, but also input from subject matter experts, data from a customer center or the website. In the ideal case, feedback from former policyholders may even be available. In general, the more high-quality data, the better the predictions of churn will be. At the same time, it would be presumptuous to wait for the perfect data set. The entry hurdle for an initial prediction model is manageable. It is more important to approach the goal iteratively. This means starting with the existing database, developing an initial predictive model, and then looking at the extent to which an improvement in the scope or quality of the data could deliver added value.

3. identify changes

As fascinating as it is to understand your own customers and their reasons for churn, only deriving and implementing measures delivers real added value. Ideally, the reasons for churn can be ranked according to their influence and quick improvements identified. If deriving measures is not possible at this stage, further data analysis can be used. An evaluation of frequently occurring measures in other industries can also be helpful. Depending on the measure, the adjustments will benefit all customers, a selected group of customers, or the presumed churning customers.

Even if the OKP comprises a fixed scope of services, there is room for maneuver for optimization measures in the design of the services. In the area of supplementary insurance, there is further potential for product improvements. For example, free digital supplementary services are increasingly finding their way into the insurance environment and represent potential for product improvements. Customer satisfaction and loyalty are of course central elements of possible measures. It is conceivable, for example, that customers are proactively contacted and supported or that onboarding processes are optimized.

In the context of churn management, it also makes sense to re-evaluate and, if necessary, expand the company's own up-selling and cross-selling measures. Customer churn can thus be positively influenced. In addition, in the ideal case, the lost revenue from churned customers can be compensated for by up-selling and cross-selling alone (negative revenue churn).

No matter which measures are identified, they should never be developed in isolation. Methods such as human-centered design can help to identify the right measures. Using existing data, the effect of designed measures can often be tested and quantified.

Together with the measures, success factors with key performance indicators (KPIs) and their target values should also be identified so that the success of measures can be evaluated later. Defining KPIs is often difficult, especially if good reference values are lacking. However, practice shows that with some research and for assumptions made, good KPIs can be found. If the assumptions later turn out to be incorrect, individual KPIs can be discussed and adjusted afterwards.

It has become established practice for complex projects to conduct an initial pilot, and this is no different for churn management. If possible, identified measures should be tested on a reduced scale.

4. Implementation

After the comprehensive preliminary work, the implementation of the identified measures starts. Depending on the measure, the resulting changes may have an impact on employees and/or insured persons. Accordingly, it may be worthwhile to accompany the implementation with dedicated change management. Depending on the measure, the customer may not notice the implementation of churn management because the changes mainly affect internal processes, for example.

Without good measurement procedures, the effect of measures will remain unclear. If comprehensive monitoring of churn management has not yet been set up, this is the right time. Self-service business intelligence solutions are ideal here, where data has already been prepared in such a way that it can be displayed quickly and flexibly from different views. In a first step, however, reduced approaches can also be pursued here. It is important that the right data is available to assess the effect of a measure. This includes currently available company-wide statistics, for example on churn, new recruits or marketing campaigns.

If measures are taken for specific customer groups, scoring and prediction dashboards at customer level are also useful in addition to the global statistics mentioned above. Ideally, this would allow customer service representatives to view the churn risk for each customer contact and take defined measures.

5. optimize

With the created monitoring of customer churn and its triggers, changes over time can also be monitored. This makes optimization processes much easier. New ideas can be quickly checked for their effect and, if necessary, taken further.

In addition to developments in customer preferences, market dynamics must also be monitored. Assumptions and initial data of analyses and prediction models change over time (often referred to as concept drift). Therefore, the initially conducted analyses should be regularly adjusted, improved and updated with current data. The prediction model for the churn probability of a customer is also by no means static, but must be regularly adjusted with new data.

Conclusion

The introduction of comprehensive and promising churn management should be approached in a structured manner and with a clear plan. The breadth of expertise required requires coordination and at the same time holds the potential for cross-disciplinary ideas and the generation of added value. Health insurance experts, organizational talent, data analysts, privacy officers, IT experts and other stakeholders should work together in highly interdisciplinary teams. Our diverse project experience allows us to support our clients with expertise in all of these areas and to contribute accumulated best practices.

Together, we ensure that the path to churn management does not end after an initial analysis or pilot. Instead, the Eraneos solution approach lays the foundation for data-based identification of mitigating measures and for operational churn management. This not only succeeds in retaining customers, but also enriches other customer-centric initiatives with data and insights in parallel.

Quantitative understanding of risks is part of the core business of any insurance company. Since churn management is based on the quantitative assessment of churn risks and their mitigation, it fits seamlessly into the special risk competence of insurers.

Those who correctly evaluate and use their data know their customers better, anticipate needs and opportunities for new services and products, and recognize market changes and risks in time.

insurance companies must be much more consistent in their focus on customer needs and keep pace with agile competition. Hence, it is important to realize your growth potential in this challenging environment and transform yourself into an integrated financial services provider using today's technology.

We have compiled reports on our projects, interesting facts from the various competence and customer areas as well as information about our company for you here.