Data ethics for financial services companies

Well-known companies like Goldman Sachs Group Inc. have been accused of bias and discrimination when processing data in their algorithms. As a result, companies such as Microsoft and IBM are championing artificial intelligence (AI) and data ethics strategies to ensure data is handled ethically. Regulators are increasingly scrutinizing data ethics practices, further increasing the relevance of the topic.

Digital risk not only encompasses cybersecurity and data protection, but has also expanded into a new field: data ethics. Data ethics involves the study and evaluation of moral issues related to data, algorithms, and related practices in order to formulate and reinforce morally sound solutions. Specifically, it takes a closer look at moral obligations in the collection, protection, and use of structured and unstructured data that can negatively impact people and communities. This includes teaching and advocating for concepts of right and wrong behavior, transparency, and defensibility of actions and decisions made by automated/artificial intelligence (AI) with respect to general and personal data. Data ethics is of great importance to analysts, data scientists, and information technology professionals, among others. All companies that manage, use and process data must be familiar with the basic principles of data ethics.

Recently, the media have increasingly reported breaches of ethical principles. As a result, financial services companies are striving to lead the way in data ethics. If a financial services firm is perceived to be careless with data, there can be significant consequences, such as loss of customer trust, investigations by regulators, and investor backlash. These risk factors have led to data ethics becoming an issue that no financial services company can ignore. The 2020 Avanade Digital Ethics Study found that 70 percent of financial services firms plan to increase their data ethics investments in the coming years. A 2022 HWZ survey on digital ethics in Switzerland showed that 80 percent of participants across industries have or are working on a data strategy focused on data ethics. These results show that high investment in data ethics is being considered as a response to growing digital risks.

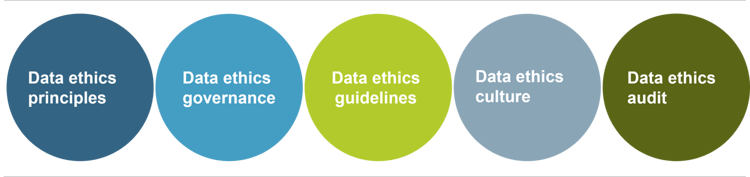

Below are some suggestions for operationalizing data ethics in financial services organizations:

1) Data Ethics Principles

Establish data ethics principles:

Fairness and representativeness

- Effort to reduce unintended bias

- Use of data of appropriate quality and context

Transparency

- Creating a shared understanding of the data ethics and goals of the initiative

- Developing a communication plan (internal and external)

Data privacy

- No unlawful or unethical collection of personal information

- Storage of personally identifiable information in a secure database

Protection and security

- Establish reliable and resilient data systems/processes against internal and external risks

- Effective monitoring of data access and breach notification procedures

- Using and processing data in an unbiased and ethical manner

Accountability

- Employees are accountable for their work

- Consideration of the long-term impact on the organization

2) Data Ethics Governance

Establish a robust and transparent data ethics governance structure:

- Establish an ethics advisory board for fundamental issues

- Define process responsibilities and role descriptions

- Communicate and promote data ethics principles

- Training and empowerment of employees

- Consultation or decision making in sensitive use cases.

3) Data ethics guidelines

Formulation of data ethics guidelines:

- Define concepts of due diligence regarding the origin of data.

- Use of existing policies and procedures

- Establish a code of ethics

- Establish best practices for data sharing

- Formulating guidelines for ethical decision making.

4) Data ethics culture

Promote a data ethics culture:

- Transfer of know-how and risk- and role-based training at all levels

- Development of a new data ethics toolbox

- Introduction into day-to-day business

- Supporting executives

- Rethinking compliance/tick box to values and principles

5) Data ethics audit

Introduce and implement relevant data ethics review and audit procedures:

- Assess data ethics risks and define mitigation measures.

- Process model for data ethics audits, including classification of "system criticality" of algorithmic systems

- Assessment of implementation of data ethics policies

- Evaluate approach to employee empowerment.

Financial services firms must ensure that data ethics is appropriately embedded throughout the organization - from legal and finance to business development - and provides a structure that meets the diverse needs of stakeholders.

Eraneos can support you in defining a framework for data ethics and anchoring it in your organization. We can offer expertise in the following phases:

- Review - We help you assess your current data ethics strategy, including relevant policies, procedures and concepts.

- Design - We help you design and develop an ethical strategy framework that includes data ethics principles, governance, guidelines, culture, and auditing.

- Monitoring - Once your data ethics strategy framework is in place, we help you define and monitor key performance indicators (KPIs) to measure the adoption and effectiveness of the data ethics strategy.

We have helped various clients embed a data ethics framework into their organization, aligned with Eraneos's framework.

In a recent banking client project, Eraneos successfully assisted in the development of a data ethics strategy as well as effective procedures to measure the feasibility of the ethics strategy. With a clear and concise data ethics governance strategy in place, our client is now better equipped to deal with an ever-changing regulatory landscape and protect stakeholder interests. This allows for increased transparency as well as trust, which enhances reputation on the one hand, integrity on the other, and promotes customer acquisition/retention.

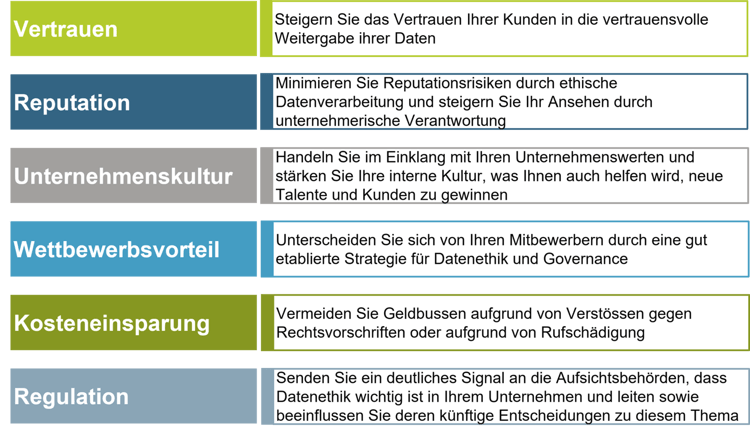

In summary, this results in the following benefits:

Don't hesitate to discuss the topic of data ethics with our experts.

We will be happy to support you in anchoring a data ethics framework in your organization.

Wir wollen aufzeigen, wie Drittanbieter mit traditionellen Banken zusammenarbeiten können und welche Aufgaben die Bank auf ihrer Seite wahrnehmen muss, um einen reibungslosen Service zu gewährleisten.

Define use cases correctly

Berichte zu unseren Projekten, Wissenswertes aus den verschiedenen Kompetenz- und Kundenbereichen als auch Informationen über unser Unternehmen haben wir hier für Sie zusammengetragen.